How to Build Recurring Revenue in Security

Are you chasing the next bid while strangling your company's value? A security integrator making $2M in profit could sell for $10M—or $26M. The only difference is the ratio of Recurring Monthly Revenue (RMR) to one-time project fees. We break down the math behind the valuation gap, why commercial churn is lower than you think, and the specific compensation structures needed to turn your sales team from hunters into farmers. Stop leaving millions on the table.

The Project-Only Trap: Why Security Companies Are Leaving Millions on the Table

Here's a number that should keep you up at night: A security company making $2 million in yearly profit might sell for $10 million—or $26 million. Same profits. The difference? How much of that revenue comes from monthly service contracts versus one-time projects.

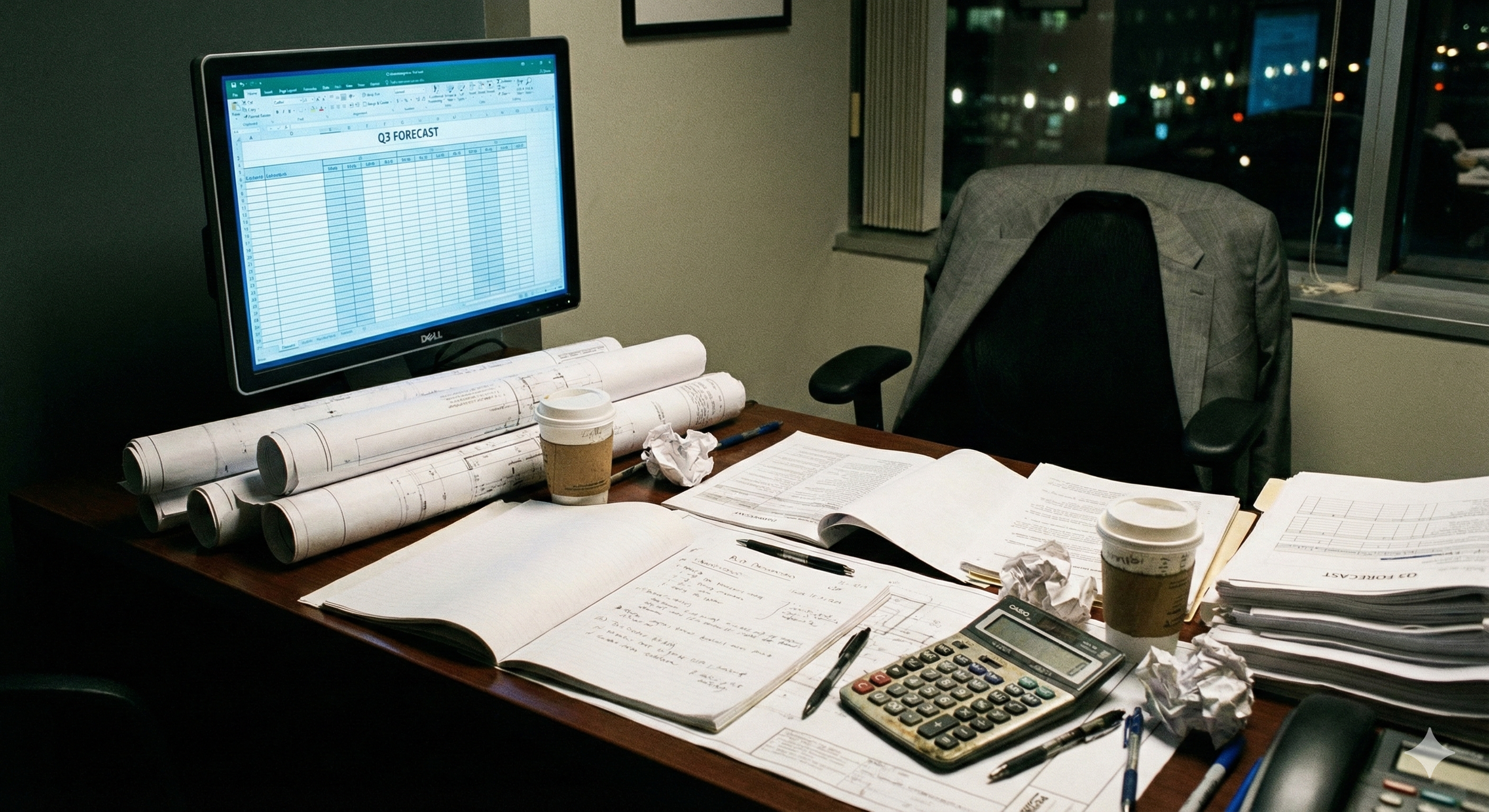

If you're like most security integrators, you finished your last install, collected the check, and immediately started hunting for the next project. The cameras work. The access control system is humming. The client is happy.

Now what? Find the next bid. Chase the next big install. Repeat.

This cycle feels normal. It's how the industry has worked for decades. But here's what nobody tells you: this "project-only" business model is slowly strangling your company's value—and your future options.

Let me walk you through why monthly service revenue changes everything, and exactly how to start building it into your business.

Key Takeaways:

Security companies with 50% RMR sell for 2-3x more than project-heavy companies with the same profits

Commercial security customers cancel at only 6-9% per year—far stickier than residential

Cloud services and active monitoring are the highest-value types of recurring revenue

Restructuring sales compensation is the single fastest way to increase RMR attachment rates

Why Is Project-Based Revenue Risky for Security Companies?

Think about your cash flow for a moment. When you run a project-based business, money comes in waves. You land a big job, cash flows in. Then you're hunting again, and things get tight. Land another job, breathe easy. Miss a few bids, and suddenly payroll feels scary.

This feast-or-famine cycle creates three big problems:

You can't plan ahead. When you don't know what's coming in next month, it's hard to hire good people, invest in training, or upgrade your tools.

You're always starting from zero. Every quarter, every year, you have to rebuild your revenue from scratch. That's exhausting.

Your company isn't worth much to buyers. If you ever want to sell your business or bring in investors, here's the hard truth: project-based security companies sell for far less than companies with steady monthly income.

A company making $2 million in yearly profit with mostly project revenue might sell for $8-10 million. That same company, if half its revenue came from monthly service contracts, could sell for $20-26 million.

Same profits. Completely different value.

What Is RMR and Why Does It Matter?

RMR (Recurring Monthly Revenue) is the subscription-based income that security companies earn every month from monitoring, maintenance, cloud services, and managed services—without selling anything new.** It's the money that shows up every single month without you having to sell anything new.

Think of it like this: your projects are one-time purchases. RMR is a subscription—like Netflix or a gym membership, but for security services.

Here are common types of RMR in our industry:

Monitoring fees: Alarm monitoring, video monitoring, fire alarm monitoring

Maintenance contracts: Quarterly check-ups, preventive maintenance, guaranteed response times

Cloud services: Hosted video storage, cloud-based access control, mobile credentials

Managed services: You manage and maintain their entire security network

The magic of RMR is simple math. If you have 100 customers each paying $500 per month, that's $50,000 coming in—every single month—before you sell a single new project.

Next month, it's still there. The month after that, still there.

This steady income does three things for your business:

It pays your bills even during slow periods. Project revenue can dry up. Monthly contracts keep the lights on.

It makes your business predictable. You can plan hiring, equipment purchases, and growth because you know what's coming in.

It makes your company worth more. Buyers and investors pay premium prices for businesses with reliable, repeating revenue.

What Types of RMR Are Most Valuable?

Cloud and software services are the most valuable type of RMR, followed by active monitoring, then maintenance contracts. Equipment leasing ranks lowest.** Here's something most integrators don't realize: buyers and investors rank different types of monthly revenue differently. Some RMR is worth a lot more than others.

Think of it like tiers:

Top Tier: Cloud and Software Services. This includes hosted video storage, cloud-based access control, and mobile phone credentials. These services have the highest profit margins—often 70% or more. They're also the "stickiest." Once a customer is using your cloud platform, switching to a competitor is painful. This is the gold standard.

Second Tier: Active Monitoring. This covers alarm monitoring, fire alarm monitoring, and remote video monitoring where someone is actively watching cameras and responding to alerts. These services have solid margins (40-60%) and customers rarely cancel because the service is essential to their safety.

Third Tier: Maintenance and Service Contracts. This includes preventive maintenance visits, inspection services, and software update management. Margins are lower (30-50%) because these often require truck rolls and technician time. But they're still valuable—they keep you connected to the customer and create opportunities to sell higher-tier services.

Bottom Tier: Equipment Leasing. If you're financing equipment and calling the lease payments "RMR," be careful. Buyers see through this. Leasing revenue doesn't mean the customer is sticky—it just means they haven't paid off their hardware yet. Once the lease ends, so does the revenue.

The takeaway: focus your energy on building top-tier and second-tier revenue. A $500/month monitoring contract is worth more to your company's value than a $500/month equipment lease—even though they look the same on your income statement.

How Do You Evaluate Security Projects for RMR Potential?

Not all projects are equal. Some build long-term value. Others just keep you busy without building anything lasting.

Here's a simple way to score every opportunity in your pipeline. Rate each project on these six factors:

1. Can you attach the monthly services?

High score: The project naturally leads to monitoring, maintenance, or managed services

Low score: It's a one-time install with no service opportunity

2. What technology are you installing?

High score: Cloud-based or hosted systems (these require ongoing subscriptions)

Low score: Standalone equipment the customer owns outright

3. What type of customer is it?

High score: Businesses in regulated industries (healthcare, finance, cannabis) or large enterprises that need ongoing support

Low score: Price-sensitive small businesses or one-location retail

4. How long is the contract?

High score: Multi-year service agreements with auto-renewal

Low score: One-time project with no ongoing relationship

5. What are your margins on the service?

High score: 50% or better profit margins on the monthly service

Low score: Thin margins where you barely break even

6. Can this customer grow?

High score: Multi-location businesses or companies with expansion plans

Low score: Single site with no growth potential

Add up your scores. Projects scoring in the top third should get your best attention and resources. Projects scoring in the bottom third? Either restructure them to include monthly services, or think hard about whether they're worth your time.

Here's the mindset shift: a smaller project with great monthly revenue potential is often more valuable than a huge project with zero service opportunity.

How Do You Convert Security Installations Into Recurring Revenue?

The best security companies have figured out how to attach monthly services to nearly every install. Here's how they do it:

Strategy 1: Make Services Part of the Package

Stop presenting service contracts as an add-on or afterthought. Build them into your standard proposal.

Instead of "Here's your $50,000 camera system, and if you want, we also offer monitoring for $500/month," try this:

"Here's your complete security solution. This includes the camera system, professional installation, 24/7 monitoring, quarterly maintenance visits, and our guaranteed 4-hour response time. The system is $50,000, and the ongoing service is $500/month."

When service is presented as part of the complete solution—not an optional extra—more customers say yes.

Strategy 2: Use the "Land and Expand" Approach

Sometimes you need to win the install first, then build the relationship. Here's how:

Month 1: Win the installation project. Do excellent work.

Month 2: Check in with the customer. Introduce them to your "system health monitoring" service. Show them a dashboard that proves their cameras are recording and their systems are working. Offer it for a monthly fee.

Month 3-4: Now that trust is established, introduce bigger opportunities. Remote video monitoring that can replace a security guard. Managed access control services. Cyber security audits for their networked cameras.

The key is having a plan for what comes after the install. Don't just finish the job and disappear.

Strategy 3: Solve Problems They Don't Know They Have

Your customers have headaches they might not even realize you can fix. Here are conversation starters:

"What happens when your facility manager gets a false alarm call at 3 AM?"

"If your main gate stopped working tomorrow, what would that cost you in delayed shipments?"

"When's the last time someone checked if your cameras are actually recording?"

"Are you confident your video system would pass a compliance audit?"

These questions uncover pain points. Then you position your monthly service as the solution to that specific pain

Quick Win: The Guard Replacement Pitch

Here's one of the most powerful RMR pitches in the industry. If your client has security guards, do the math with them.

A security guard making $25 per hour costs about $18,000 per month for round-the-clock coverage. That's salary, benefits, training, management, and the inevitable sick days and turnover.

Remote video monitoring where a trained operator watches cameras live and responds to threats through speakers costs $1,500 to $3,000 per month. The client saves 80% or more. You gain high-margin monthly revenue that renews year after year.

This isn't about replacing all guards everywhere. It's about finding sites where technology can do the job better and cheaper and turning that into recurring revenue for your business. Not just "a service contract."

How Should You Structure Sales Compensation to Drive RMR?

The fastest way to increase RMR is restructuring sales compensation to reward recurring revenue as much as project sales. Here's a hard truth: if you pay your sales team only on project revenue, they'll focus only on projects.

Most sales reps get paid when they close a deal. A $100,000 install might pay them a $5,000 commission—right away. A $500/month service contract? Maybe $25-50 commission. Which one do you think they'll spend their time selling?

To build RMR, you need to make it worth your salespeople's time.

The Multiplier Approach: Pay your reps 100% of the first year's monthly revenue as an upfront commission. That $500/month contract becomes a $6,000 commission. Now it's competitive with project commissions.

The Gate Approach: Salespeople can't collect their project commission until they've attached a minimum amount of monthly services. If the rule is "20% of project value must be in RMR," then a $100,000 project requires $20,000 in annual service revenue (about $1,700/month) before the rep gets paid.

These approaches work because they align what's good for the salesperson with what's good for the company.

The Culture Shift: From Hunters to Farmers

Traditional security integrators celebrate the "big kill." Land a million-dollar project? Ring the bell. Close a huge contract? You're the hero.

This "hunter" mentality rewards one-time wins. But building RMR requires a different mindset—what some call the "hunter-farmer" hybrid.

Farmers don't just plant seeds and walk away. They water. They weed. They tend. They harvest over time.

Building monthly revenue means:

Checking in with customers after the install

Having dedicated people focused on growing existing accounts

Measuring success by customer lifetime value, not just project size

Celebrating retention and expansion, not just new logos

This doesn't mean you stop hunting new business. It means you also cultivate the customers you already have.

How Do You Reduce Customer Churn and Protect RMR?

Building RMR is only half the battle. You also have to keep it.

The good news: commercial security customers are remarkably loyal. Industry data shows that commercial clients cancel their service contracts at a rate of only 6-9% per year. Compare that to residential customers, who cancel at 12-14% annually. This means your commercial RMR is stickier and more valuable.

But even low cancellation rates add up over time. Here's how to protect the monthly revenue you've worked so hard to build:

Build price increases into your contracts. Include a clause that allows 3-5% annual price increases. Most customers accept this as normal. It offsets your rising costs and actually grows your revenue base even if you don't add new customers.

Check in before problems happen. Don't wait for the service call. Schedule quarterly reviews with your best customers. Show them the system health reports. Identify issues before they become complaints.

Make cancellation painful. Not through tricks or traps, through value. The more integrated your services become with a client's operations, the harder it is to switch. A monitoring contract is easy to cancel. A fully managed security network that ties into their HR system and compliance reporting? That's a relationship.

What Are the First Steps to Building Recurring Revenue?

Here's your action plan:

Week 1: Score your current pipeline using the six-factor system above. Identify which opportunities have the highest RMR potential.

Week 2: Review your last 10 completed projects. How many included monthly services? If the answer is less than half, you have a packaging problem.

Week 3: Rewrite your standard proposal template to include service as part of the core offering, not an add-on.

Week 4: Have a conversation with your sales team about compensation. Map out what it would take to make RMR commissions competitive with project commissions.

Month 2: Create a 90-day post-installation plan for every project. What check-ins happen? What upsell conversations occur? Who owns this?

The Bottom Line

The security industry is changing. Companies with steady monthly revenue are pulling ahead they're more stable, more valuable, and better positioned for the future.

If 80% of your revenue comes from projects, you're working too hard for too little long-term benefit.

Start small. Attach service to your next project. Then the next one. Build the muscle. Change the culture. Fix the compensation.

In three to five years, you won't just have a more stable business. You'll have a fundamentally more valuable company.

The question isn't whether you can afford to make this shift. It's whether you can afford not to.